Car insurance is one of those things we all need but wish we didn’t have to pay so much for. While it’s essential for protecting your vehicle (and your wallet in case of accidents), the rising premiums can be frustrating. But what if I told you there are some smart, legal, and totally doable ways to cut down your car insurance costs without compromising coverage?

Yes, you heard that right! In this blog, we’ll walk through 8 clever tricks to help you reduce your car insurance premium while still keeping your car well-protected. Let’s get started!

1. Compare & Choose the Best Insurance Provider

If you’ve been renewing your insurance with the same provider year after year without checking for better deals, you might be overpaying. Different insurance companies offer different rates, so comparing multiple quotes can save you a significant amount.

How to Do It?

- Use insurance comparison websites to get quotes from multiple providers.

- Check for customer reviews and claim settlement ratios before making a switch.

- Don’t hesitate to negotiate with your current insurer if you find a better deal elsewhere.

Pro Tip: Insurance companies compete for business, so always ask, “Can you beat this price?” You’d be surprised how often they do!

2. Increase Your Voluntary Deductible

A deductible is the amount you agree to pay out-of-pocket before your insurance kicks in. If you opt for a higher voluntary deductible, your insurance provider reduces your premium as they see you as a lower risk.

How to Do It?

- If you have a good driving record and don’t make frequent claims, consider increasing your deductible.

- Calculate how much you can afford to pay out-of-pocket in case of a minor accident.

- Choose a balance where you save on premiums but aren’t stuck with a hefty bill during an emergency.

Caution: Don’t choose an excessively high deductible that you can’t afford in case of a claim.

3. Drive Safely & Maintain a Clean Driving Record

Your driving habits directly impact your insurance premium. Insurers reward safe drivers with lower premiums, as they pose a lower risk for accidents and claims.

How to Do It?

- Follow traffic rules, avoid speeding, and drive responsibly.

- Avoid frequent claims, as multiple claims make insurers see you as high risk.

- Check if your insurer offers a ‘No Claim Bonus (NCB)’ for not making claims.

Bonus: Some insurers offer telematics-based policies, where they track your driving habits and give discounts for safe driving!

4. Install Anti-Theft Devices & Safety Features

Insurance companies love security! If your car is equipped with certified anti-theft devices, insurers offer discounts because the risk of theft is lower.

How to Do It?

- Install security features like GPS trackers, steering locks, and car alarms.

- Ensure the device is Automobile Research Association of India (ARAI)-approved to qualify for discounts.

- Inform your insurer and provide proof of installation.

Win-Win: You get discounted premiums while also protecting your car from thieves!

5. Bundle Your Insurance Policies

Many insurers reward loyal customers with discounts when they bundle multiple policies together, such as car + home insurance or multiple vehicles under one policy.

How to Do It?

- Check with your current provider for multi-policy discounts.

- If you own multiple cars, see if a family fleet policy saves money.

- Consolidate policies to simplify renewals and payments.

Savings Tip: Bundling policies can often save you 10-20% on premiums—not bad for just asking!

6. Choose Pay-As-You-Drive or Usage-Based Insurance

If you don’t drive your car frequently, consider a pay-as-you-drive or usage-based insurance policy. Instead of a fixed premium, insurers charge based on how much you actually drive.

How to Do It?

- Check if your insurer offers telematics-based insurance.

- Install a device that tracks your driving patterns and mileage.

- Enjoy lower premiums if you drive less than the average user.

Best For: People who work from home, own multiple cars, or drive only occasionally.

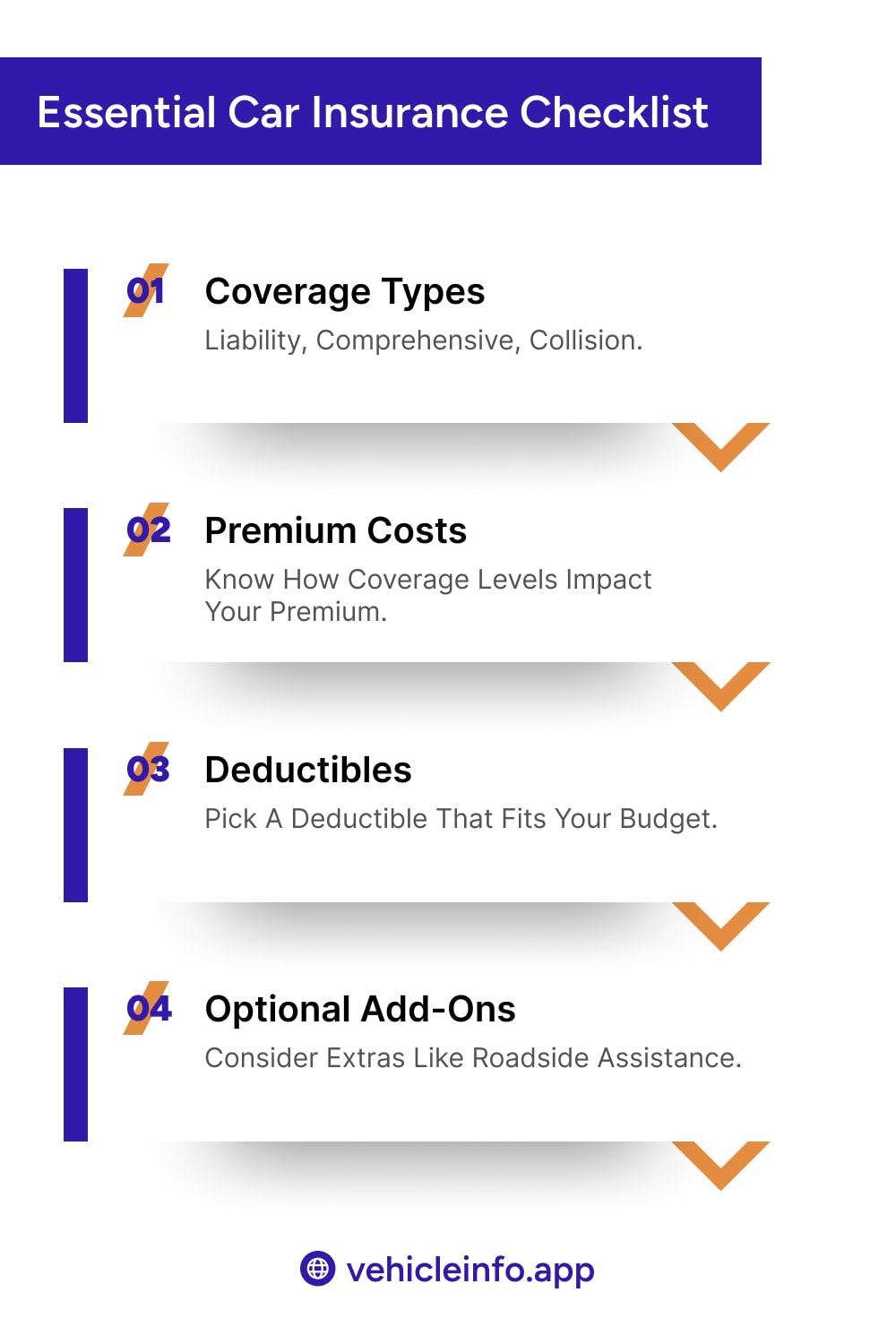

7. Avoid Unnecessary Add-Ons

While add-ons like zero depreciation cover, engine protection, and roadside assistance can be useful, not all of them are necessary for everyone.

How to Do It?

- Review all add-ons before renewing your policy.

- Only keep the ones that make sense for your car’s age and usage.

- Remove unnecessary covers to reduce your overall premium.

Example: If your car is parked safely in a garage and rarely driven in flood-prone areas, do you really need engine protection cover? Probably not!

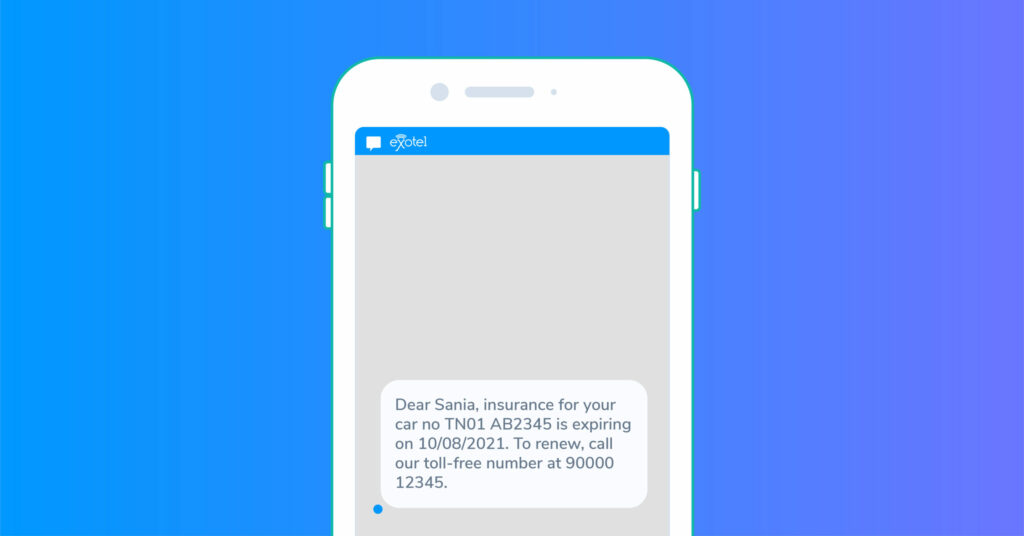

8. Renew Your Policy on Time & Avoid Lapses

Insurance premiums can increase if you miss your renewal date. Lapsed policies may also lose accumulated discounts like No Claim Bonus (NCB).

How to Do It?

- Set a reminder a few weeks before renewal.

- Renew on time to continue enjoying NCB discounts.

- Avoid last-minute renewals, which might lead to policy lapses or increased premiums.

NCB Perks: If you don’t claim insurance for 5 consecutive years, your NCB discount can be as high as 50% on premiums!

Final Thoughts: Save Big on Car Insurance!

Car insurance doesn’t have to be expensive if you use these 8 smart tricks. To recap:

✅ Compare policies & negotiate for better deals.

✅ Opt for a higher deductible if you can afford it.

✅ Drive safely & maintain a clean record.

✅ Install security features to lower risks.

✅ Bundle policies to enjoy discounts.

✅ Consider usage-based insurance if you drive less.

✅ Remove unnecessary add-ons to cut costs.

✅ Renew your policy on time to retain NCB benefits.