Buying a car can be expensive, but a car loan can help! A car loan lets you borrow money to buy a car and pay it back over time in small amounts, called EMIs (Equated Monthly Installments). Banks and financial companies offer these loans with different rules and interest rates.

This guide will help you understand car loans in a simple way. You will learn how they work, who can get one, what documents are needed, and tips to get the best deal.

What is a Car Loan?

A car loan is money a bank or financial company gives you to buy a car. You agree to pay back the money with extra charges (interest) over a set number of months. Until you finish paying, the bank owns the car, but you get to use it.

Most banks give 85-90% of the car’s cost, and some even offer full 100% financing if you qualify.

Types of Car Loans

There are different kinds of car loans:

New Car Loan – Money to buy a brand-new car.

Used Car Loan – Money to buy a second-hand car (may have higher interest).

Loan Against Car – You get money by using your existing car as security.

Electric Car Loan – Special loan with lower interest for electric vehicles (EVs).

Balloon Payment Loan – Smaller payments at first and a big payment at the end.

Lease Purchase Loan – You pay for the car in parts and own it after the final payment.

Zero Down Payment Loan – No money needed upfront; the bank gives full cost.

Top-Up Loan – If you already have a car loan, you can borrow more money on top of it.

Who Can Get a Car Loan?

You can get a car loan if you meet these rules:

Age: 21-65 years

Income: At least ₹20,000 per month (salaried) or ₹2 lakh per year (self-employed)

Credit Score: 750+ (higher scores help get better deals)

Job Stability: Salaried (at least 1 year) or self-employed (at least 2 years)

Down Payment: Some lenders ask for 10-20% of the car’s price upfront.

Documents Needed for a Car Loan

When you apply, you must give some papers:

For Salaried People:

Identity proof (Aadhaar, PAN, Passport, Voter ID, Driving License)

Address proof (Utility bill, Aadhaar, Passport, Ration Card)

Salary slips (last 3-6 months)

Form 16 or latest Income Tax Returns (ITR)

Bank statements (last 6 months)

Employer verification letter

For Self-Employed People:

Identity and address proof

Business proof (GST certificate, business license, etc.)

ITR for the last 2-3 years

Bank statements (last 12 months)

Profit & Loss statement (if applicable)

Car Loan Interest Rates

Interest rates vary based on the lender and your profile.

Fixed or Floating Rate: Fixed stays the same, floating can change.

Interest Rate Range: Between 7% and 15% per year.

What Affects Rates: Credit score, loan amount, car type, down payment, and loan time.

Reducing Balance Interest Rate: Interest reduces as you pay off the loan.

Government Benefits: Some electric cars have lower rates.

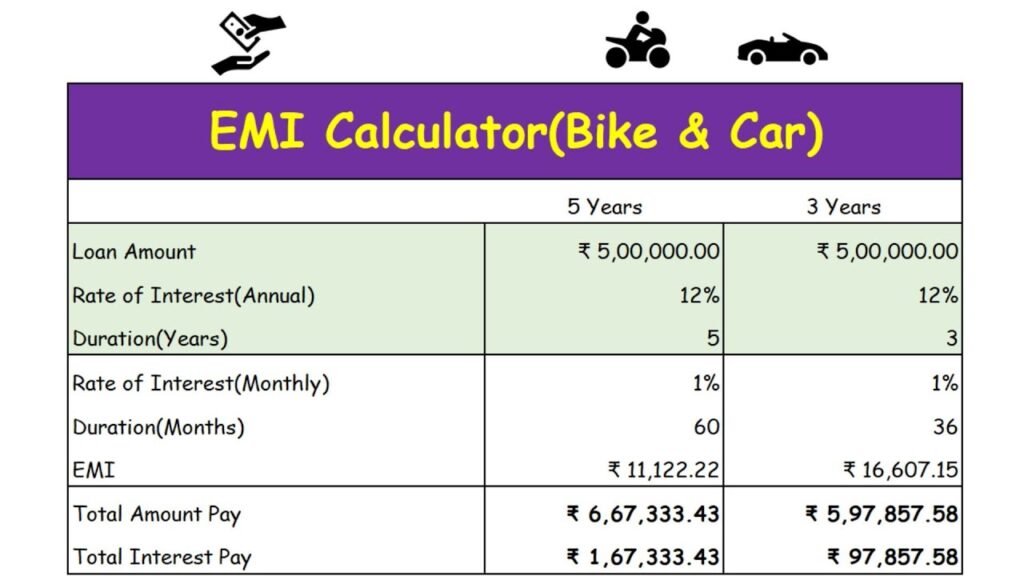

How to Calculate Car Loan EMI?

To find out how much you will pay every month, use this formula:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

Where:

P = Loan Amount

R = Monthly interest rate (Annual Rate/12/100)

N = Loan time in months

Or, use an online EMI calculator to find out quickly.

Steps to Get a Car Loan

Applying for a car loan is simple. Follow these steps:

Check Eligibility – See if you qualify by using online tools.

Compare Loans – Look at different banks for the best deal.

Choose Loan Amount & Time – Pick an amount and time you can afford.

Apply for Loan – Fill out the form online or at a bank.

Submit Documents – Give the required ID and income papers.

Wait for Approval – The bank checks and approves the loan.

Get the Money – Once approved, the bank pays the car dealer, and you get the car.

Tips to Get the Best Car Loan

Keep a Good Credit Score – A score of 750+ gets you a lower interest rate.

Pay a Bigger Down Payment – This reduces your loan and monthly payments.

Pick a Shorter Loan Time – Shorter loans mean less total interest paid.

Negotiate for Better Terms – Ask for lower rates if you have a good record.

Watch for Extra Charges – Look out for processing fees and penalties.

Prepay if Allowed – Some banks let you pay early to save on interest.

Know the Rules for Ending Loan Early – Some banks charge fees for early closure.

Think About Loan Insurance – Helps cover payments in case of an emergency.

Mistakes to Avoid

Not Checking Loan Offers: Always compare before choosing a lender.

Ignoring Extra Costs: Processing fees, penalties, and other charges add up.

Picking the Wrong Loan Time: Longer loans mean more interest paid.

Not Reading the Terms: Always read and understand the agreement.

Taking More Loan Than Needed: Ensure you can comfortably pay the EMIs.

Conclusion

A car loan helps you buy a car by splitting the cost into monthly payments. Knowing how loans work helps you pick the right one. Compare different lenders, use EMI calculators, and plan your payments wisely.

If you’re thinking about getting a car loan, research your options and choose the best deal. Happy driving!