When purchasing a vehicle, one of the most crucial steps is ensuring that the car you’re eyeing doesn’t come with any financial baggage, like a pending loan. A vehicle with an outstanding loan can lead to significant legal complications, financial burdens, or even the repossession of the vehicle, leaving you with nothing to show for your investment. Before finalizing the deal, it’s essential to conduct thorough checks to determine whether the vehicle is free of any financial obligations. In this blog, we’ll guide you through the steps to Check If a Vehicle Has a Pending Loan and what precautions you should take to safeguard yourself during the buying process.

Key Points

- Ask the Seller Directly

- Check the Vehicle’s Registration Certificate (RC)

- Run a Vehicle History Report

- Verify with the Regional Transport Office (RTO)

- Contact the Financing Bank or Lender

- Look for Hypothecation Details

Ask the Seller Directly

It’s not fool proof, but asking upfront if there’s a pending loan can save you time. Most honest sellers will tell you if the vehicle is financed or fully paid off. You can casually say Hey, is this car loan-free, or does it still have some dues? If they hesitate, dodge the question, or seem unsure, that’s your first red flag. Pair this with other checks, though, because not every seller will spill the beans.

Why It Works: A direct question puts the seller on the spot, and their response can give you a gut feeling about their trustworthiness.

Pro Tip: Ask for proof, like a loan clearance certificate (also called a No Objection Certificate or NOC), if they claim it’s paid off.

Check the Vehicle’s Registration Certificate (RC)

The RC is like the car’s ID card it holds crucial info. Look for a line that says Financed by or Hypothecation followed by a bank or lender’s name. If you see this, the vehicle likely has a pending loan. Hypothecation means the car is collateral for a loan, and until it’s cleared, the lender technically has a claim on it.

How to Do It: Ask the seller to show you the original RC (not just a photocopy). Cross-check the details with the car’s chassis and engine numbers.

Pro Tip: Some sneaky sellers might show a fake RC, so feel the paper it should have a slight texture, not feel like plain printer paper.

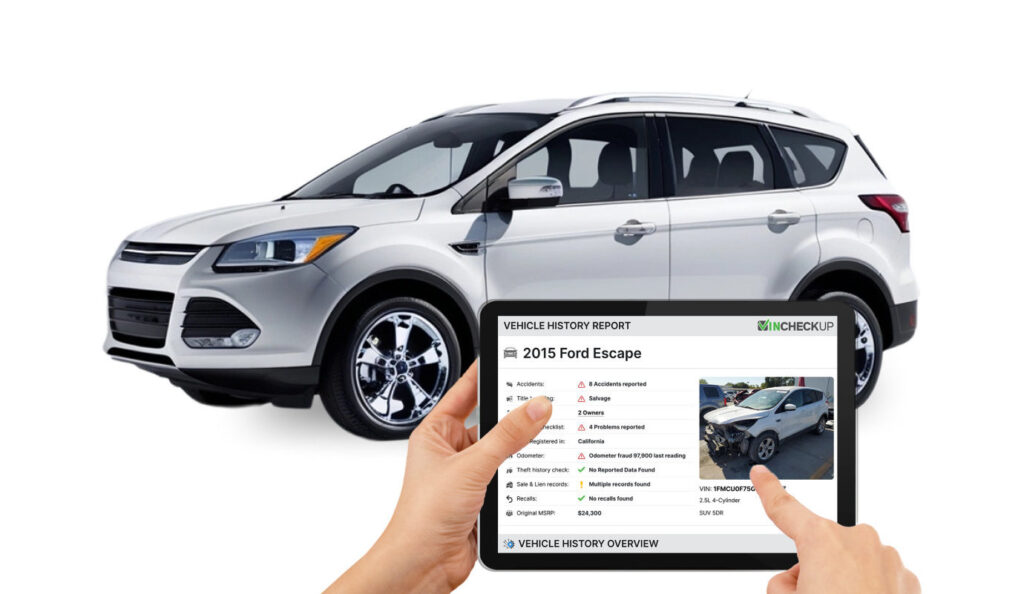

Run a Vehicle History Report

Think of a vehicle history report as a background check for your car. Services like Carfax, Auto Check, or local equivalents (like India’s Vahan portal) can reveal if the vehicle has an active lien or loan. You’ll need the Vehicle Identification Number (VIN) or registration number to run the report. These reports often cost a small fee, but they’re worth every penny for peace of mind.

Why It’s Awesome: Beyond loans, you’ll also uncover accident history, ownership changes, and more.

Pro Tip: Not all loans get reported perfectly, especially if it’s a private lender, so combine this with other steps.

Verify with the Regional Transport Office (RTO)

The RTO is the ultimate authority on vehicle records in most countries. Visit your local RTO office or their online portal with the car’s registration number. They can confirm if the vehicle is under hypothecation or if the loan has been cleared. In some places, like India, you can use the Parivahan website to check this instantly.

How to Do It: Enter the registration number online or ask an RTO officer to pull up the details. You might need to pay a small fee.

Pro Tip: RTO records are legally binding, so this is one of the most reliable checks you can do.

Contact the Financing Bank or Lender

If the RC or history report lists a bank or lender, reach out to them directly. Give them the vehicle’s registration or VIN number and ask if there’s an outstanding loan. They won’t share personal details about the borrower (privacy laws!), but they can confirm if the car is still financed.

Why It Matters: This cuts through any seller excuses and gets you the truth straight from the source.

Pro Tip: Be polite and professional say you’re a potential buyer doing due diligence. Most banks are happy to help.

Look for Hypothecation Details

Hypothecation is a fancy word for “the car’s tied to a loan. Even if the seller claims the loan is paid, check if the hypothecation has been officially removed from the RC. If it hasn’t, the lender could still claim the vehicle. You’ll see this in the RC or RTO records. To remove hypothecation, the seller needs an NOC from the lender and must update the RC.

Why It’s Tricky: Some sellers don’t bother updating the RC after paying off the loan, which can cause confusion.

Pro Tip: If hypothecation lingers, ask the seller to sort it out before you buy it’s their responsibility, not yours!

Conclusion

In conclusion, taking the time to Check If a Vehicle Has a Pending Loan before purchasing is a vital step to ensure a smooth and trouble-free transaction. By following the proper steps, including verifying the car’s title status, checking with the lender, and running a vehicle history report, you can avoid costly surprises down the road. Taking the time to do your due diligence will not only protect you legally and financially but also provide peace of mind as you move forward with your purchase. Always remember, a little research can go a long way in making sure your investment is secure.

FAQs

Q1. What happens if I buy a car with a pending loan?

Ans. If the loan isn’t cleared, the lender can legally repossess the car, even after you’ve paid the seller. You could lose the car and your money unless you take legal action, which is a hassle.

Q2. Can I remove hypothecation myself after buying?

Ans. No, only the borrower (usually the seller) can clear the loan and get the NOC to remove hypothecation. Insist they do it before you buy.

Q3. Are online vehicle history checks always accurate?

Ans. They’re reliable for most registered loans, but small private loans might slip through. Cross-check with the RTO for certainty.

Q4. How long does it take to verify with the RTO?

Ans. Online checks are instant if the portal works. In-person visits might take an hour or two, depending on the office.

Q5. What if the seller refuses to share the RC?

Ans. Walk away! No RC means no transparency, and that’s a huge risk when buying a used vehicle.

Q6. How can I Check If a Vehicle Has a Pending Loan?

Ans: You can check by reviewing the RC, verifying with the RTO, running a vehicle history report, and contacting the financing bank.